unrealized capital gains tax canada

Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Short-term capital gains are taxed at your ordinary tax rate.

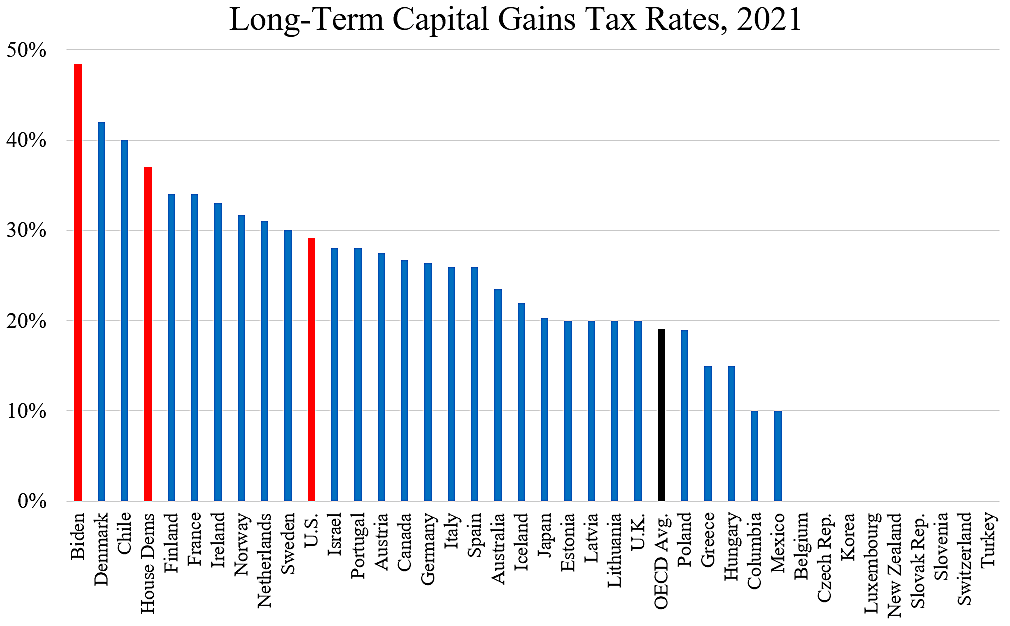

An Overview Of Capital Gains Taxes Tax Foundation

33 Dividends from a publicly listed company are 85 taxable resulting.

. 2 Realized capital gains from the sale of primary residences have always been exempt from taxation in Canada. 3 The 1994 average income of a typical tax filer affected by. If the equity investment value increases you must pay capital gains tax.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. However capital gains from the sale of residential homes is tax-free after two years of residence with certain limitations. As we head toward another federal budget to be released on March 22 there is much speculation about a change in the capital gain inclusion rate from 50 to 6667 or.

The sale price minus your ACB is the capital gain that youll need to pay tax on. This example is pretty black and white -. Below is how the federal tax brackets break down for the 2021 tax year.

Long-term capital gains are taxed at the following rates. As the foreign exchange of the account balance will fluctuate after the year-end it is considered unrealized. 0 for taxpayers with taxable income of 40400 or less for single filers 41675 or less in 2022 or 80800 for.

Regardless of whether or not the sale of a capital property results in a capital gain or loss you have to file an income tax and benefit return to report the transaction even if you do not have. For example if you. Non-resident corporations are subject to CIT on taxable capital gains 50 of capital gains less 50 of capital losses arising on the disposition of taxable Canadian property.

In 2022 those rates range from 10 to 37. 7950 2400 5550. As a result an adjustment may be required on Schedule 1 of the.

If you hold an asset for more than one year before you sell for a. Unrealized hold a crypto- no realized gain- no taxable event-no tax. The CRA allows taxpayers to defer their capital gains tax burden by up to three years meaning you can defer either your losses or your gains to years when it will have the.

In Canada 50 of your capital gain is. In Canada 50 of the value of any capital gains is taxable. Capital gains are in two categories.

Investors pay Canadian capital gains tax on 50 of the capital gain amount. Realized sell a crypto for fiat - realized gain- taxable. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say.

If you decide to sell youd now have 14 in realized capital gains. Deduct this ACB from the sale price. In our example you would have to include 1325.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. A stock or piece. This means you have a capital gain because its more than your ACB.

Partial Taxation of Capital Gains.

Taxing Unrealized Capital Gains

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Capital Gains Taxes And The Democrats Downsizing The Federal Government

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Top Democrat Proposes Annual Tax On Unrealized Capital Gains Wsj

Bitcoin On Twitter Fyi Many Countries Implement A Wealth Tax Or Something Like An Unrealized Capital Gains Tax Examples Argentina 5 25 Canada 0 4 France 1 5 Spain 3 75 Netherlands 1 2 Norway 0 85 Switzerland

How Capital Gains Tax Works In Canada Forbes Advisor Canada

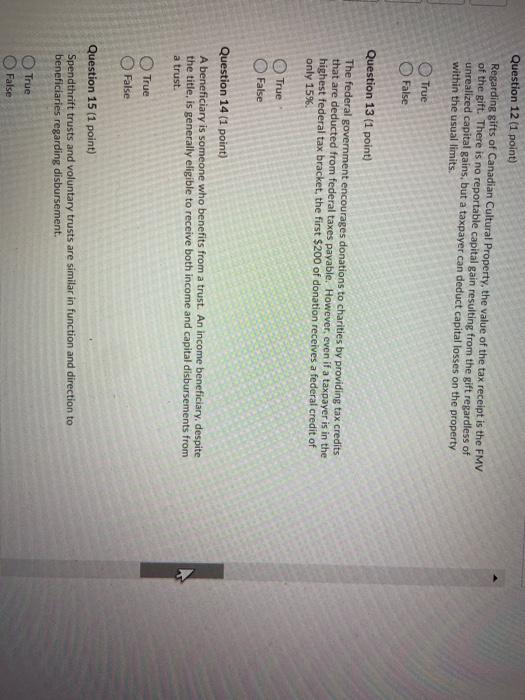

Solved Question 12 1 Point Regarding Gifts Of Canadian Chegg Com

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

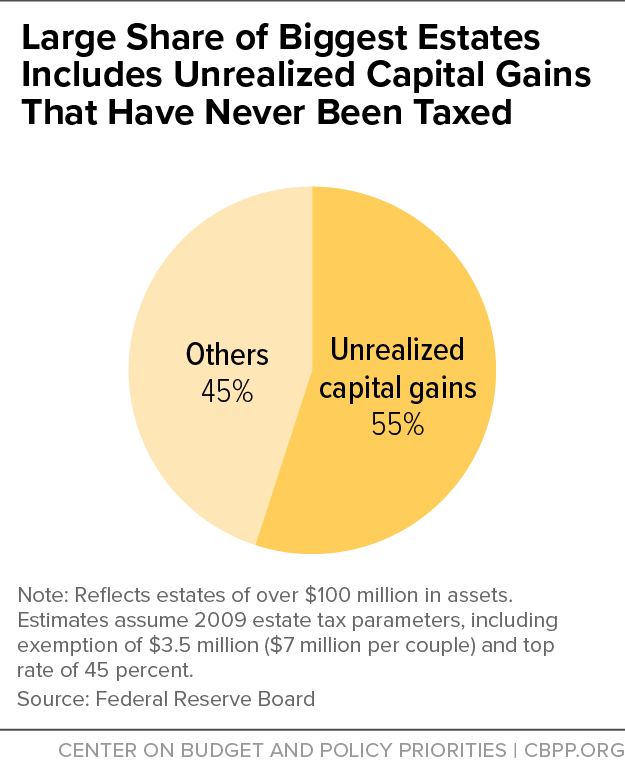

Large Share Of Biggest Estates Includes Unrealized Capital Gains That Have Never Been Taxed Center On Budget And Policy Priorities

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Capital Gains Tax International Liberty

Canada Crypto Tax The Ultimate 2022 Guide Koinly

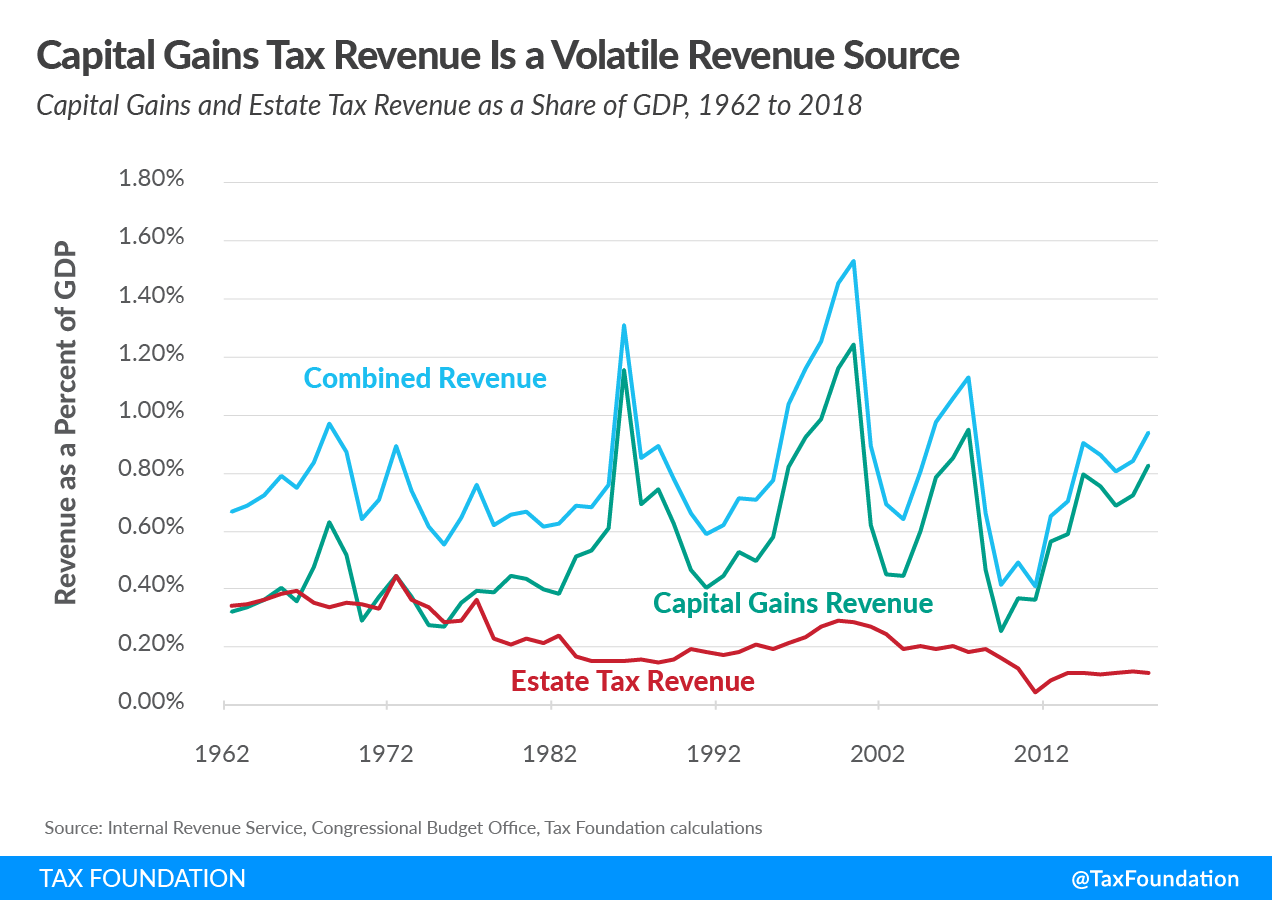

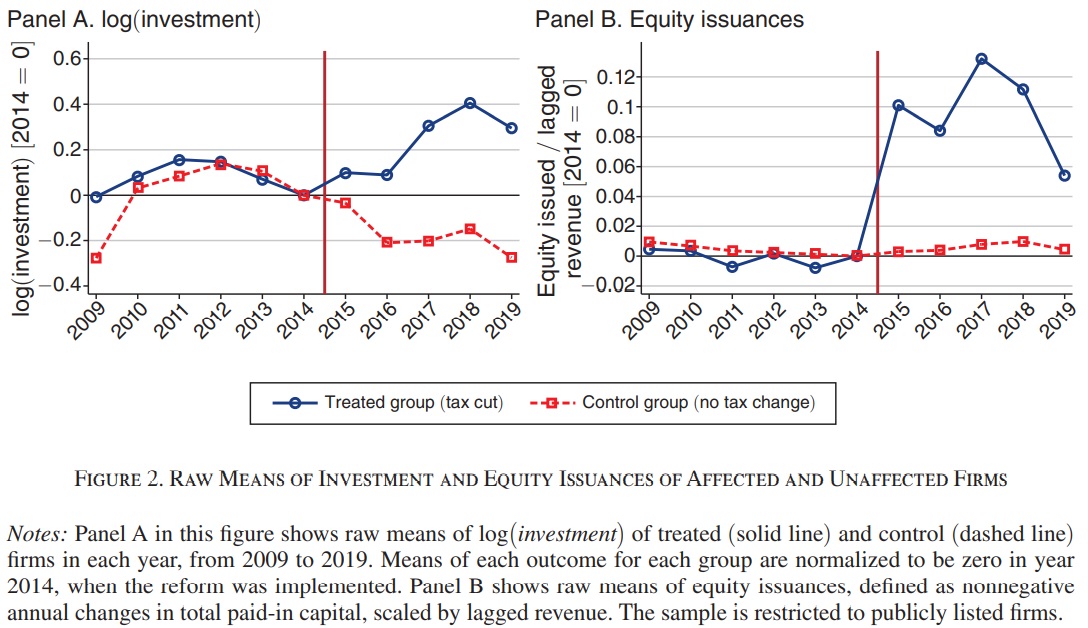

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/tgam/52EQNADWOFFJVEXQSGMQNZO2SA.jpg)

Biden Tax Proposals Could Have A Significant Impact On U S Persons In Canada The Globe And Mail

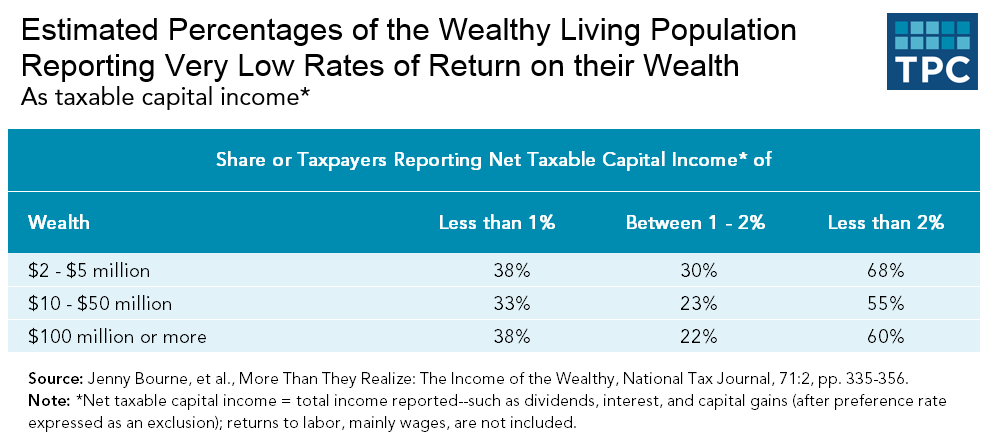

Individuals Pay Very Little Individual Income Tax On Capital Income Tax Policy Center

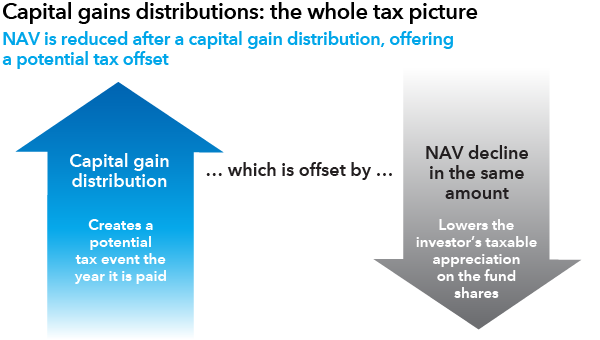

4 Tax Myths Of Mutual Funds Debunked Capital Group

The Oft Maligned Tax Increase On The Verge Of Becoming Law Politico